Overview

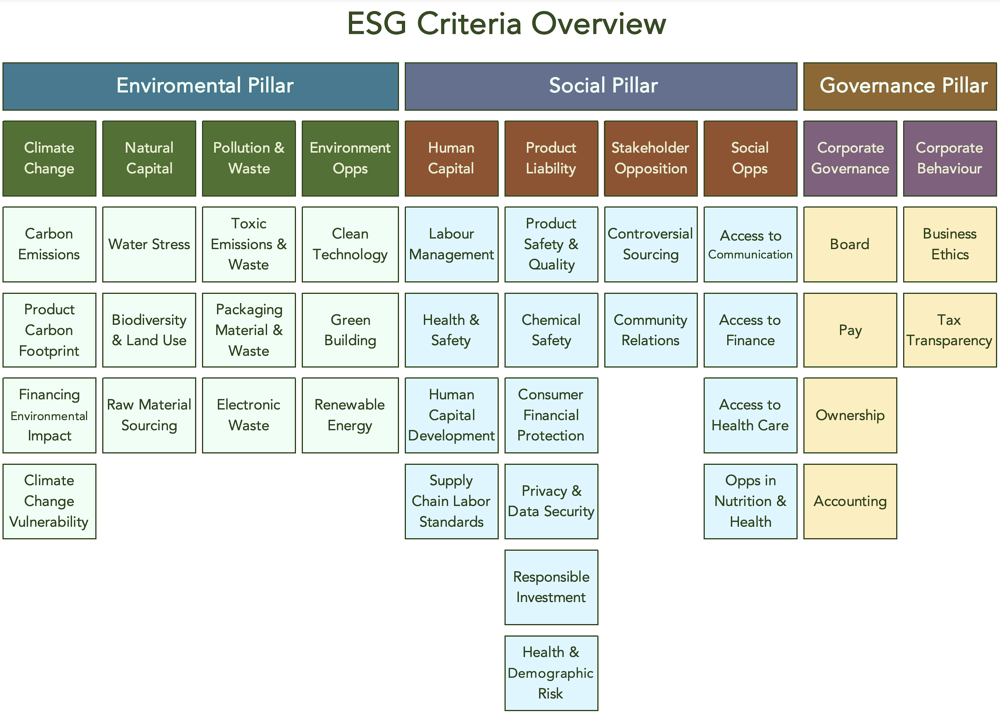

ESG is a very diverse topic and stands for Environmental, Social and Governance. It includes things like:

Environmental measures and impacts

- Health and safety

- Human capital / people / employee engagement / culture / employee well-being

- Diversity, inclusion and belonging

- Community engagement and impacts

- Client satisfaction and experience

- Compliance and governance

- Stakeholder engagement

- Social and economic development

- Human rights

- Business ethics

So, it is the term used to describe the concerns that people have with whether investments are ethical, the actions taken by companies to behave in an ethical way, and the reliability of what companies and governments say they are doing to contribute to sustainability.

Who is ESG for?

ESG can relate to anybody but is mostly related to:- Investors and shareholders when talking about ethical investments, socially responsible investments, ESG wealth management, or sustainable investing;

- Employees and customers when talking about working for or buying from ethical businesses;

- Governments when talking about legislation to enforce ethical behaviour, ESG governance factors, ESG legislation, and ESG regulation; and

- Professional bodies when talking about establishing standards for reporting ethical (or non-ethical) behaviour, the principles of responsible investment, and sustainable finance.

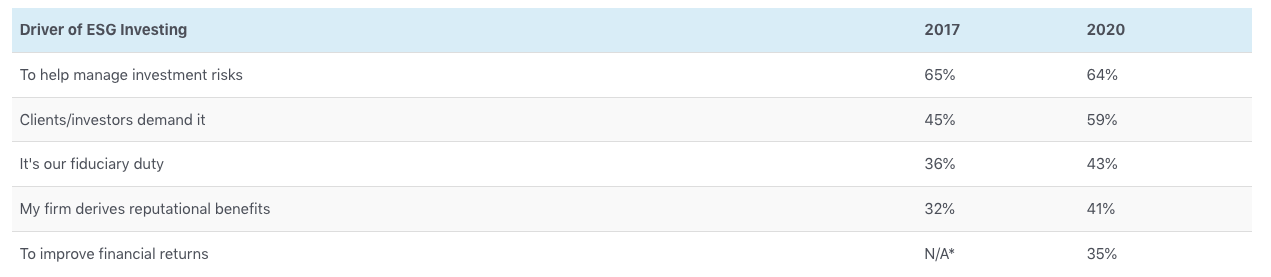

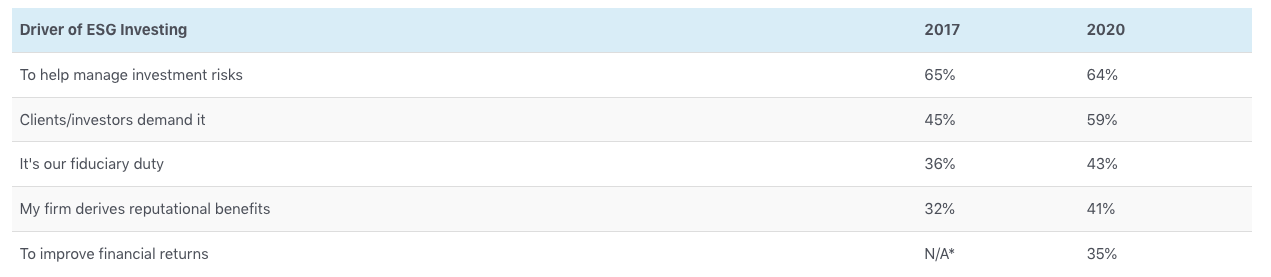

The Top 5 Drivers of ESG Investing

Based on a March 2020 survey of 2,800 CFA institute members who were asked: ‘Why do you or your organization take ESG issues into consideration in your investment analysis/decision? (Select all that apply)”

*No data available in 2017

Why is ESG important?

ESG is about justice arising from enforcing ethical behaviour, so it is at the core of the meaning of the word humanity.

Possibly the most topical subject though is climate change that might cause harm to all of us is now generally accepted across the world. ESG includes the collective global effort to arrest or severely reduce climate change so that harm to us is minimised.

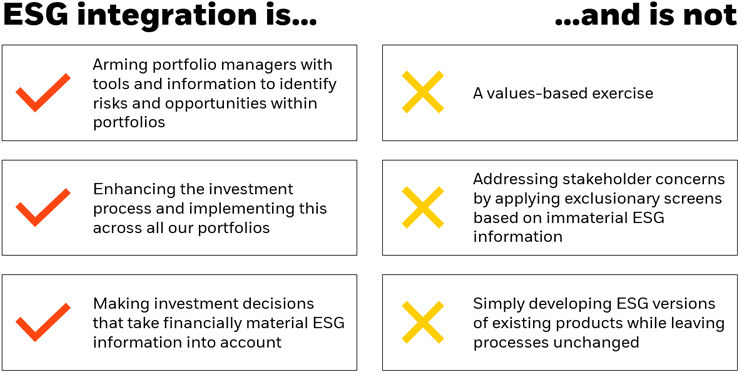

ESG is often used interchangebaly with the term “sustainable investing.” Sustainable investing is seem as the umbrella and ESG as a data toolkit for identifying and informing our solutions. ESG data is most often categorized as “non-accounting” information because it captures components important for valuations that are not traditionally reported. Company valuation has become more complex, with a growing portion tied up in intangible assets. ESG metrics provide insights into these intangibles, such as brand value and reputation, by measuring decisions taken by company management that affect operational efficiency and future strategic directions.

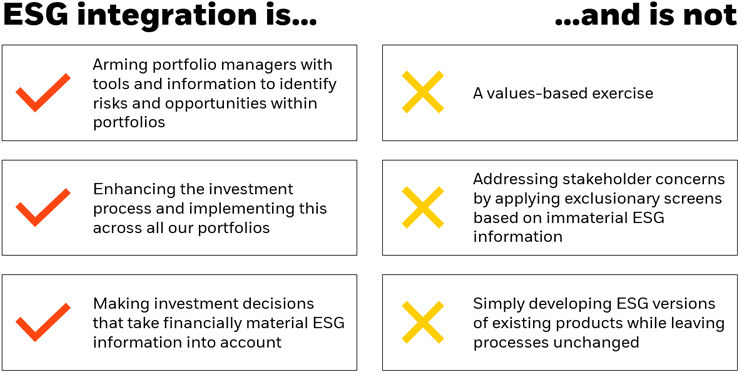

The ESG considerations that are material will vary by investment style, sector/industry, market trends, and client objectives. ESG integration is about using research, data and insights to inform investment decisions.

Sustainability issues can contribute to a company’s long-term financial performance. Incorporating these considerations into the investment research, portfolio construction, portfolio review and stewardship processes can help enhance long-term risk adjusted returns.

What does ESG mean for Australian companies?

- There are already some global ESG frameworks that attempt to set standards for companies to act in an ethical way and to report about what they are doing about ESG and particularly sustainability but there is no one global standard. One such incomplete standard is the United Nations Sustainable Development Goals.

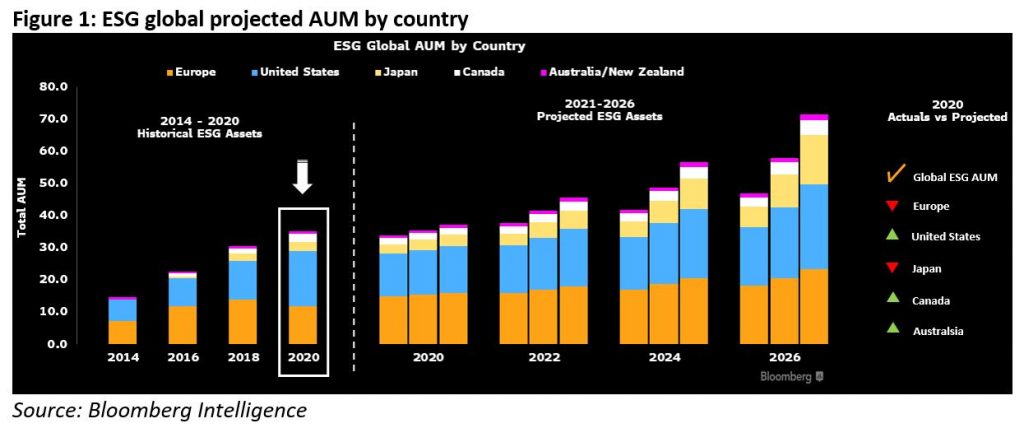

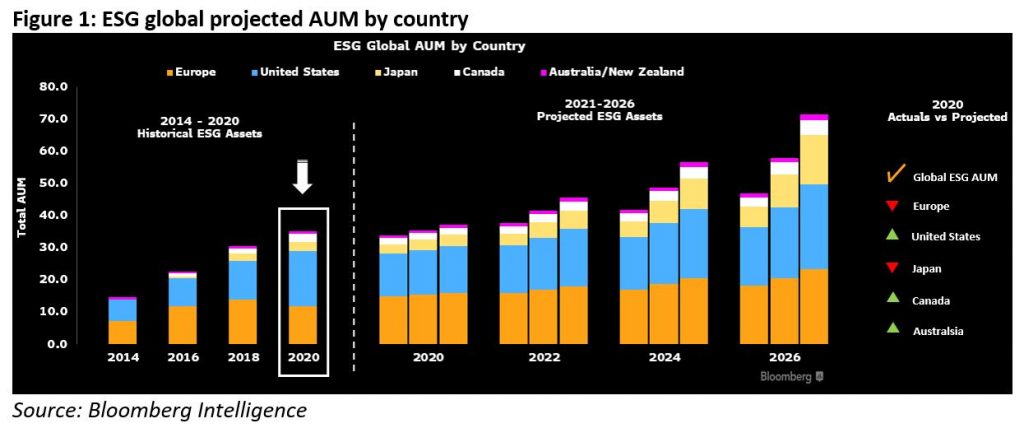

- Because there are virtually no ESG standards or laws in Australia companies here are finding it increasingly difficult to attract international investors who are seeking ethical investments.

- Also, for the same reasons, younger generations increasingly choose not to work for companies that don’t behave ethically and sustainably.

- Australia will need to accelerate the development of its ESG standards, legislation and regulations to “catch up” with Europe, U.S.A. Canada, Singapore and others if we are to remain truly competitive.

- It is now proven that good ESG performance results in a positive impact on share price. Company Directors have a fiduciary duty to protect their shareholder’s value. Thus, Directors are at personal risk if they are found not to be appropriately managing ESG and sustainability considerations.

What does ESG mean for shareholders?

Because there are many companies that rate other companies on their ESG performance a large pool of information exists that investors can use to rank potential investments on the basis of ESG performance. This has led to share price differentials between companies with good ESG performance when compared to those with poor ESG performance. Investors and shareholders therefore should consider the impact they can have on retention of the investment value by including ESG performance as investment criteria.

What does ESG mean for employees?

Younger generations are increasingly choosing to work with companies that have good ESG credentials and because of those credentials are generally more successful. This means that the finest talent is generally migrating to those companies who can also afford to offer higher employee rewards. So, companies with good ESG performance offer greater rewards, higher satisfaction levels and the chance to work with the finest talent.

How does AppO impact your ESG behaviour?

AppO takes the emotion out of business decisions and uses strongly supportable statistical techniques to make decision recommendations so decisions become entirely transparent to employees and others. Thus, stakeholders (customers, shareholders etc.) can clearly see that influences on company behaviour are appropriately balanced or not. This leads to better business decisions that can save a lot of money but also leads to much greater confidence that an organisation is actually doing what it reports it is doing.