PPM Vs PPO - What's the Difference?

Introduction

If you search the web you will find, amongst the marketing hyperbole, definitions that rightly indicate that Portfolio Optimisation is the part of the Portfolio Management process, which prioritises and balances a portfolio of investments. To understand Portfolio Optimisation and how it relates you therefore need to understand Portfolio Management.

What is a Project Portfolio?

A portfolio is a collection of homogenous things such as drawings or paintings that an artist might have but in business it tends to relate to a collection of investments.

Investment portfolios are commonly viewed in terms of the type of assets that form the portfolio. That type is known as the asset class. Asset classes are usually viewed as things like equities (stocks), fixed income (bonds), cash and cash equivalents, commodities, real estate, infrastructure, private equity, and hedge funds etc.

We maintain that an organisation should consider itself the “Our business” asset class and view the change initiatives within the organisation as investments in that asset class, which allows much of the knowledge related to managing portfolios of investments to be applied in business transformation. It also allows valid comparison with investments in the traditional asset classes such as equities. In any case, each asset class has different regulatory environments and performance characteristics that drive specialisation of the portfolio and its management.

This article focuses on the management of portfolios of investments in “Our business” assets.

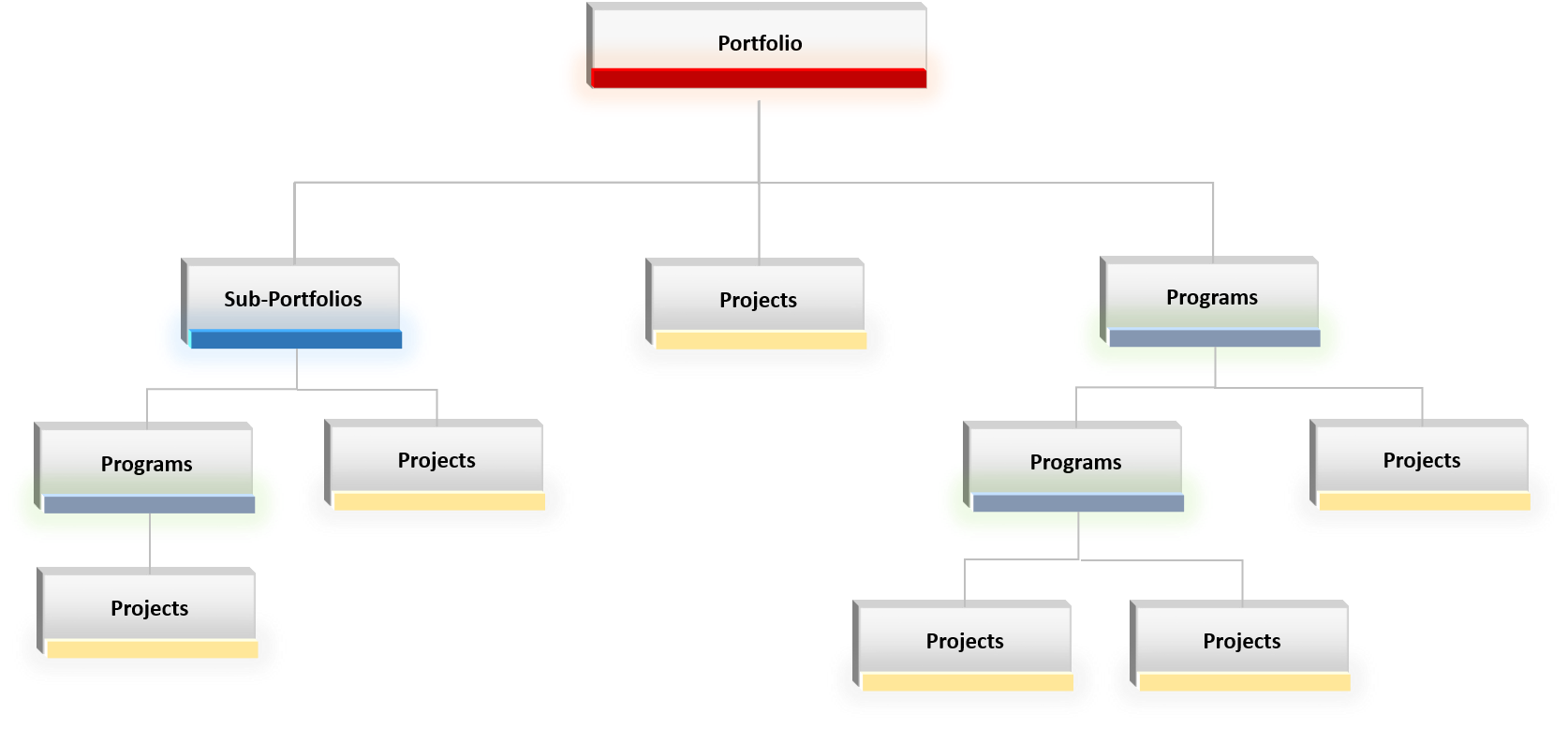

Individual investments in “Our business” are commonly known as projects. Groups of projects that if managed separately would not achieve all the planned benefits are commonly known and programs. Collections of programs and projects are known as “Project Portfolios” and usually include all the change initiatives affecting a particular business, or perhaps an individual business unit, which could be thought of as a sub-portfolio.

Like all other asset classes, investments in “Our business” have a lifecycle that starts from an idea that if we invest resources in changing our business in some way we might reap rewards and ends when the rewards are gained or not. This means that there is always the risk that the planned rewards will not be gained.

The Project Lifecycle Governance Process

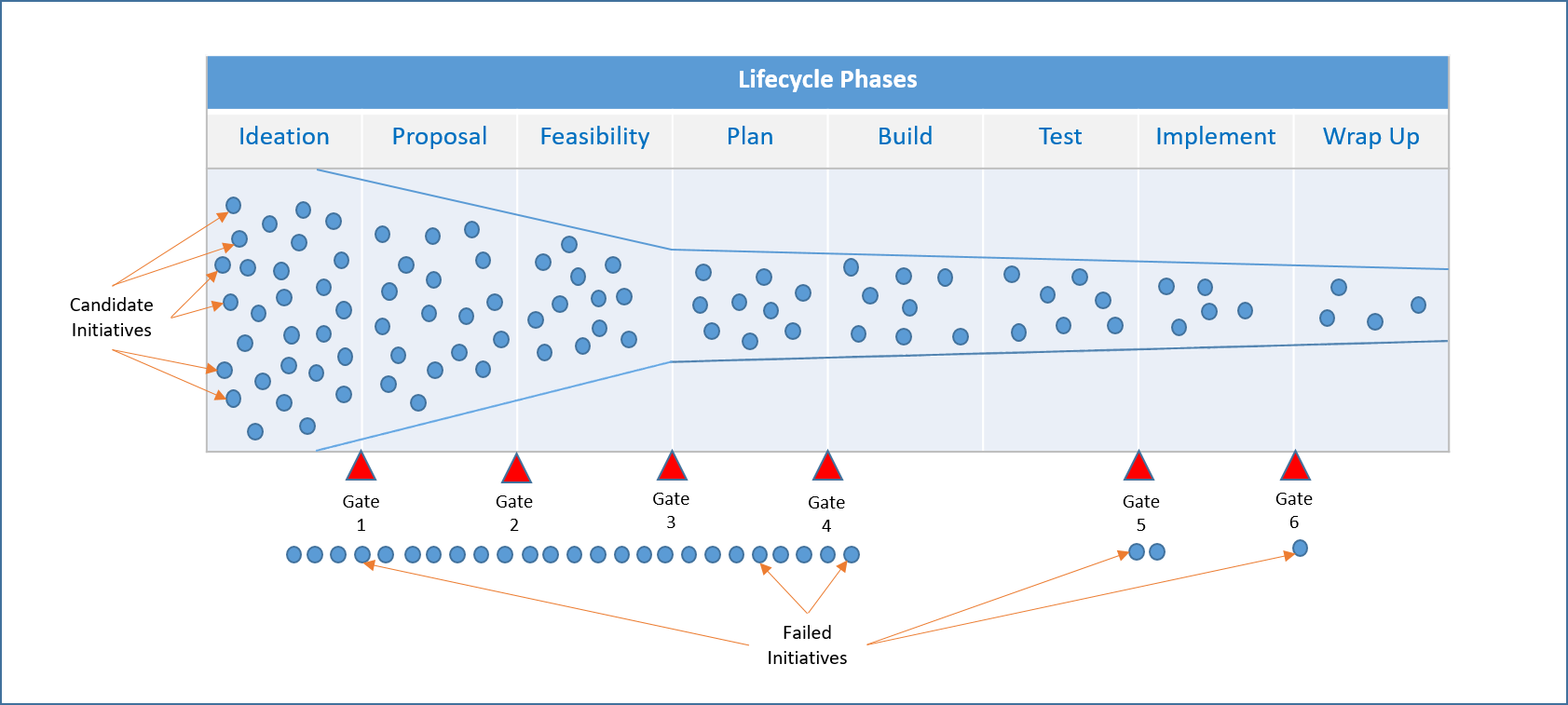

As an initiative progresses though the life-cycle of idea through discovery and on to development and implementation the total cost increases by the nature of the resources being applied. So the risk of a greater loss increases as the initiative progresses.

Most organisations choose to manage the risk by applying business rules and processes that effectively provide a filtering mechanism to “weed out” those that don’t meet the required criteria for investment. As investments progress through the lifecycle business rules are applied at various inspection points, commonly known as “Gates”, which determine if the investment continues to progress and in what form or if the investment is terminated. This process is called “Lifecycle Governance”.

It is very common that the Lifecycle Governance process is structured into a series of phases and gates that collectively govern transformation investments from concept to some form of fruition. Those investments being controlled by the governance process can be considered a pipeline.

The notion of a pipeline confirms that a portfolio of investments will likely include investments at all stages of that lifecycle, some just starting as ideas, some being planned, some involved in executing the approved plan and others harvesting the benefits and wrapping up. In the case of transformation these are commonly known as the Initiate (Ideation, proposal, and feasibility), Plan, Execute (Build, test, and implement) and Close (Wrap Up) phases of the pipeline. In construction the phases are known as concept, definition, design and development, construction or manufacturing, operations, and termination. In asset management the phases are known as Demand (Need), Plan (Concept, Specify, Procure), Acquire (Design, Build, Integrate, Accept), Operate/Maintain (Operate and maintain, Evolve), and Dispose.

What is Project Portfolio Management?

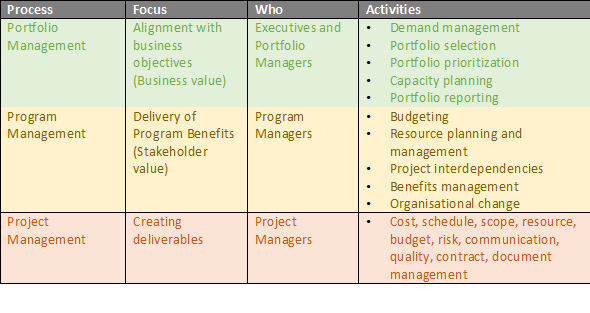

The activities focused on optimisation of the business value derived from the application of resources that are being consumed, or are proposed to be consumed in progressing investments through all phases of the pipeline is portfolio management. If the pipeline relates to transformation investments, or perhaps asset maintenance etc. then it is known as “Project Portfolio Management”.

Note that the focus of Portfolio Management is alignment with business objectives, which are usually defined in the strategy development process.

What is Project Portfolio Optimisation?

A project portfolio should maximise the business value that can be achieved from available resources while managing any negative impacts related to the business environment and the inter-relatedness of initiatives within the potential portfolio. Project Portfolio Management reiteratively asks and then answers two questions:

QUESTION 1 – “In a perfect world, in what sequence should we execute the investments in our portfolio to achieve maximal business value given our available budget allocation?” In other words, “What is the most valuable investment in relation to our business objectives we could make right now, second most valuable, third most valuable, fourth etc.?” – This activity is Portfolio Optimisation and includes sub-processes of portfolio prioritisation and portfolio budgeting. During this activity it is incumbent on portfolio management to continually analyse the available business value from each initiative and make recommendations when significant additional value could be gained from relatively minor adjustments to budgetary allocations.

QUESTION 2 – “What changes to our “perfect world” portfolio execution sequence are necessary to manage resource availability and possible negative impacts derived from the business environment or inter-relatedness of the proposed portfolio initiatives?” – This activity is Portfolio Scheduling and includes sub-processes of resource management, risk management, and portfolio scheduling.

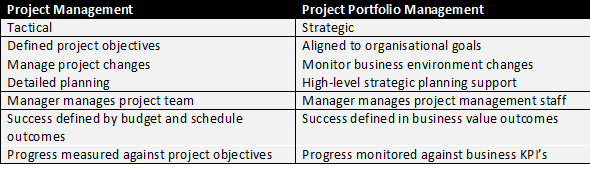

How does Project Portfolio Management Differ from Project Management?

The characteristics of Project Management and Project Portfolio Management are compared in the following table:

Get an Implementation Readiness Assessment

We offer an assessment of your organisation's readiness to implement AppO (or any Portfolio Prioritisation tool) covering people, processes, and systems, including:

- Organisation

- Governance and gating

- Strategy Development

- Strategy Delivery

- The Executive

The assessment will include:

- Issues and opportunities

- Recommendations

- Next steps

- High-level implementation plan