Which option provides the greatest advantage?

The locality of the investment often contributes to the criteria by which the investment is measured.

For example, the market behaviors in India will impact decisions to invest there, which will be different from the considerations of market influences in the U.S.A. or Australia for example.

Thus, choosing between investments in different markets can be problematic.

Very similarly, investments made in one business unit may be measured differently from investments made in others and investments to support one product suite may also be very different from others.

Until now and under these circumstances the judgement that one is more advantageous than another has relied on opinion admittedly usually supported by analyses however, the usage of opinion can introduce significant risk.

What if you could eliminate the risk by analysing your potential investments against the hierarchy of value measures appropriate for each investment but have a common way of measuring which was most advantageous?

The Concept of Relative Business Value

To determine if one alternative is of higher value than another we would need a measure that we could call Relative Business Value (RBV) to rank each investment opportunity because business decisions are about choosing the most beneficial solution but always having rational alternatives (Plans b,c,d, etc.) should problems arise with the first (second, third, etc.) choice.

Conceptually then, to develop a Relative Business Value score we would need to apply all of the criteria appropriate for each investment and calculate some sort of universal numerical equivalent that equals the relative contribution of that investment to each and all criterion. Then we would need some way of equating Relative Business Value scores made under differing criteria hierarchies.

Historical approaches to investment decision-making principally tested the financial aspects of potential investments, focusing on benefit-cost ratios and other business ratios to determine investment feasibility, and whether selected investments can generate incremental value. This approach generally, but unfortunately, ignored other tangible and intangible characteristics that collectively constitute “business value”. Such considerations may include safety and risk but increasingly there will be considerations of societal, ecological and reputational impacts. Therefore, it is unlikely that all selected investments will be optimal to achieving business objectives and contribute to the delivery or creation of value.

Multi-criteria Decision Making (MCDM)

Multi-criteria decision making (MCDM) provides a structured approach to making decisions through semi-quantitative analysis. Similar to financial benefit analysis (FBA), MCDM adds a range of non-financial criteria to the mix in allowing more balanced and customer-focused investments to support the achievement of outcomes and objectives.

However, the application of pure MCDM techniques will not allow the direct comparison of results achieved under differing criterion regimes. To do so would require the extension of Multi-criteria Decision Analysis (MCDA) techniques to ensure the equivalence of Relative Business Value scores in these conditions.

With that extension it should not matter what hierarchy of value measures is used to determine Relative Business Value, the relativity of the number will hold so that options considered using differing criteria hierarchies, as would occur when considering investments in differing markets or countries, can be compared – The higher the number, the greater potential contribution to value generation for the business.

The calculation of RBV in this manner would be an extension of the works of Saaty (Analytic Hierarchy Process, 1978,1980) and Thurlstone (Pairwise Comparison, 1927), which has been tested globally for over forty years.

Provided that a reasonable level of care is taken to analyse the investment opportunity for bias (intended or unintended), provided the value measures are reasonable and the processes and people used to develop any assessments of value and suitability are reasonable, decisions made using an extended MCDM RBV calculation will be defendable and could be substantiated to any stakeholder group as rational and robust.

What Does RBV Measure?

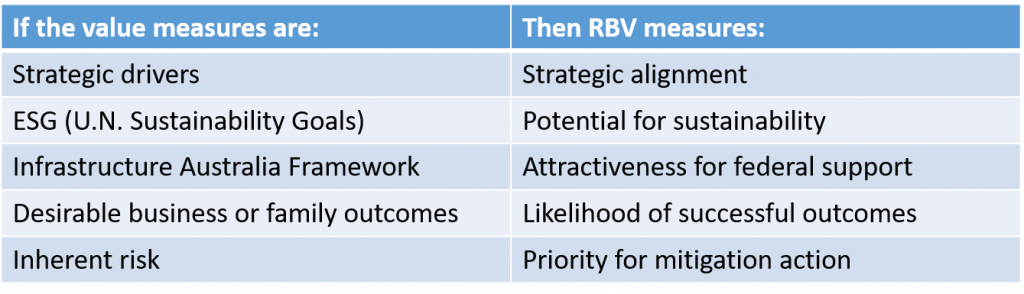

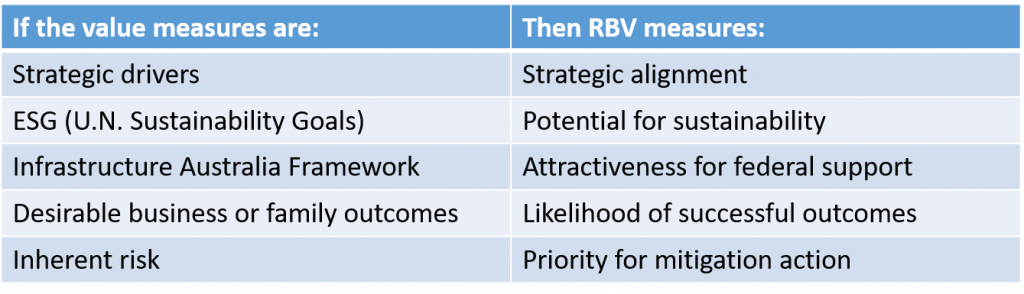

The simple answer is that what RBV measures depends on what you want it to measure. Most commercial organisations will usually look for RBV to measure strategic alignment, however increasingly complex business decisions must be measured against a range of value criteria. Please look at the following table for a few examples:

But, in the end, any RBV score developed an extended RBV calculation, regardless of which hierarchy of criteria is applied to the investment opportunity can be directly compared to any other investment opportunity to which another hierarchy of criteria has been applied.

This means that it is now possible to support decisions to invest in one market, or business, or product suite, for example, over another by applying and extension to Multi-criteria Decision Analysis.

Get started with MCDM

Arrange a demonstration of MCDA

Ask a question or ask for help